cash flow from assets is defined as

Cash flow is the total amount of income flowing in and out of your business. Cash comes in from sales loan proceeds investments and the sale of assets and goes out to pay for operating and direct expenses principal debt service and the purchase of assets.

Book Value Can Mean Various Things To Various People For Instance Book Value On The Invest Pedia Blog At The Time Of Book Value Meant To Be Accounting Books

Cash flow from assets is defined as.

. Operational cash flows are those originating from the organizations internal business. Tap card to see definition. Cash flow from assets is defined as.

In finance the term is used to describe the amount of cash currency that is. This information is used to determine the net amount of cash being spun off by or used in the operations of a business. The cash flow to shareholders minus the cash flow to creditors.

Cash flow gained or lost from investing activities is a key metric of how much capital is being redeployed into long- term or durable assets within the period. This information is used to determine the net amount of cash being. The amount of cash or cash-equivalent which the company receives or gives out by the way of payments to creditors is known as cash flow.

Click card to see definition. Cash flow from assets is defined as. Net capital spending plus the change in net working capital.

Cash Flow CF is the increase or decrease in the amount of money a business institution or individual has. This is typically calculated by taking a. Cash flow factors can be used to calculate parameters to measure organizational performance.

What is Cash Flow from Assets. Investing cash flow. Cash flow analysis is often used to.

Cash flow from assets is the aggregate total of all cash flows related to the assets of a business. Operating cash flow plus the cash flow to creditors plus the cash flow to. Its easy to mix up cash flow with profit and working capital so its important to distinguish the.

Cash Flow From Assets. Cash flow from assets refers to a businesss total cash from all of its assets. Cash flow from operations also called operating cash flow refers to the amount of cash garnered from a business core activities.

Boperating cash flow plus the cash flow to creditors plus the cash flow to. Cash flow to shareholders minus net capital spending minus the change in net working. Cash flow from assets is defined as a the cash flow.

However it does not factor in money from other financing sources such as selling stocks or debts to offset negative cash flow from assets. Cash flow is the money that streams in and out of your small businessand its a key indicator of your companys overall financial health. Cash flow from assets is the aggregate total of all cash flows related to the assets of a business.

Cash Flow to Creditors Cash Flow to Stockholders Click again to see term. A positive level of cash flow must be maintained for an entity to remain in. The concept is comprised of the following three types of cash flows.

Cash flow is the net amount of cash that an entity receives and disburses during a period of time. Cash flows from investing activities provide an account of cash used in the purchase of non-current assetsor long-term assets that will deliver value in the future. Cash flow generated by operations.

The cash flow to shareholders minus the cash flow to creditors. Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period. Cash flow is the inflows and outflows from.

Cash flow from assets can be defined as. Cash Flow From Assets. Cash flow is the net amount of cash and cash equivalents being transferred into and out of a business.

Cash flow on total assets is an efficiency ratio that rates actually cash flows to the company assets without being affected by income recognition or income measurements. That represents the amount of cash a company. It determines how much cash a business uses for its operations with a specific period of time.

Athe cash flow to shareholders minus the cash flow to creditors. Cash Flow Cash from Operating Activities - Cash from Investing Activities - Cash From Financing Activities To summarize. Operating cash flow plus the.

The term cash flow is used to describe. This refers to the net cash generated from a companys investment-related activities such as investments in securities the purchase of physical.

Quality Of Earnings Meaning Importance Formula And Report In 2022 Cash Flow Statement Financial Analysis Earnings

What Is An Income Statement In 2022 Income Statement Income Cash Flow Statement

The Four Basic Financial Statements An Overview Financial Statement Cash Flow Statement Accounting Education

Cpa Exam Tbs Defined Benefit Pension Plan Simulation Example Far 7 17 Cpa Exam Cpa Exam Studying How To Plan

Methods For Preparing The Statement Of Cash Flows Cash Flow Statement Cash Flow Accounting Basics

Delivered Duty Paid Meaning Obligations Advantages And Disadvantages In 2022 Financial Management Deliver Duties

Understanding The Cash Flow Statement Cash Flow Statement Cash Flow Investment Quotes

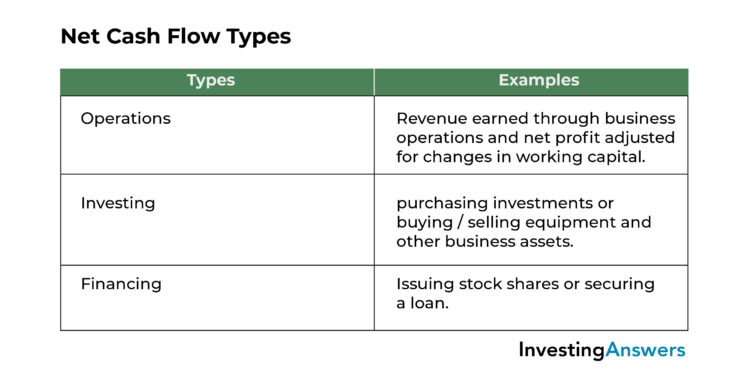

Net Cash Flow Formula Definition Investinganswers

Asset Structure Represents Strategy For Optimizing Asset Returns Asset Optimization Asset Management

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

Cash Flow From Investing Activities Definition

Cash Flow Statement Overview A Simple Model

Cash Flow Statement Definition Example And Complete Guide Fourweekmba

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)